internet tax freedom act texas

Internet access fees are currently subject to state and local sales tax in Hawaii New Mexico Ohio South Dakota Texas and Wisconsin. ITFA prohibits states and political subdivisions from imposing taxes on Internet.

Bailey Galyen Attorneys At Law The Leaders In Texas For 40 Years Free Consultations

3086 is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on.

. Little-noticed changes to the Internet Tax Freedom Act made by Congress in 2007 expanding the scope of services preempted from state taxation are at issue in Apple Inc. Internet Tax Freedom Act ITFA The ITFA was enacted in 1998 as a 3-year moratorium preventing governments at the local state and federal levels from imposing. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1.

On June 30th 2020 the Internet Tax Freedom Acts grandfather clause will expire. 105-277 which enacted in 1998 implemented a three-year moratorium preventing state and local governments. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016.

The Internet Tax Freedom Act of 1998 ITFA. On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to. It is likely that these taxes cannot be legally imposed on Internet access providers because the.

The Internet Tax Freedom Act of 1998 ITFA. The Permanent Internet Tax Freedom Act is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple. Texas collected tax on.

Passed the House on July 15 2014 voice vote The Permanent Internet Tax Freedom Act HR. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1. Internet Tax Freedom Act - Title I.

The Internet Tax Freedom Act ITFA was enacted in 1998 to delay any special taxation of. As of July 1 2020. On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the.

This report discusses the Internet Tax Freedom Act ITFA. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016. Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet.

Kentucky Michigan Ohio and Texas have recently enacted gross receipts taxes. Under the grandfather clause included in the Internet Tax Freedom Act Texas is currently collecting a tax on Internet access charges over 2500 per month.

Sales Taxes In The United States Wikipedia

State Conformity To Cares Act American Rescue Plan Tax Foundation

Conference Backs Replacing Cross And Flame

Texas Last Will And Testament Legalzoom

Texas Broadband Development Office

Salt Shaker Eversheds Sutherland State Local Tax

South Carolina S 2021 Tax Free Weekend Kicks Off On Friday August 6

San Jose Seller S Permits Ca Business License Filing Quick And Easy

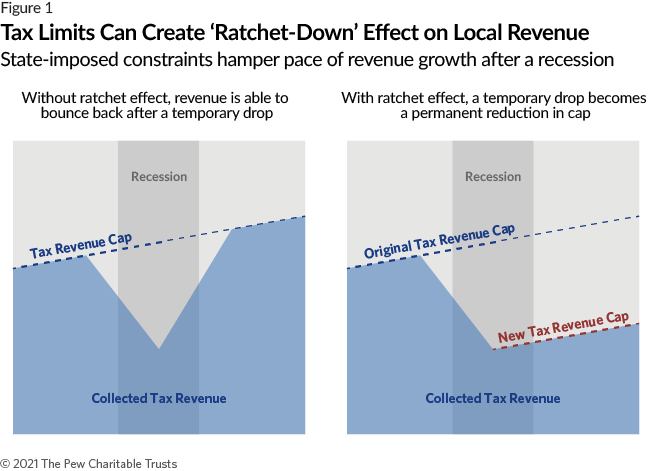

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

Roma Independent School District Homepage

Missouri Considers Law To Make Illegal To Aid Or Abet Out Of State Abortion Pbs Newshour

A Guide To State Sales Tax Holidays In 2022

Amazon Com Texas Roadhouse Gift Card 25 Gift Cards

Tax On Streaming Services Deloitte Insights

Texas Judge Deems Obamacare Hiv Prevention Drug Mandate Unlawful Reuters

Online Sales Tax In 2022 For Ecommerce Businesses By State

Texas Sales Tax Guide And Calculator 2022 Taxjar

Ohio And Texas Issue Guidance On Expiration Of Internet Tax Freedom Act Grandfather Clause Lexology